Crash Course

Paraphrased from Medium in 2016

Most people are bad with money. We're irrational animals fighting both our internal psychology, a gross lacking in knowledge / teaching on the subject and an industry that prides itself in being opaque, obfuscating and generally user-hostile.

This is a huge problem for both us as individuals who dislike being broke, and for us collectively when we deal with bigger systemic things like poverty.

Let’s be clear what this is not: this is not a decrying of the ‘unfair’ and ‘evil’ financial institutions. This is not Occupy Twitter. This isn’t Mr. Robot. The truth is, you can work minimum wage jobs and still save if you can get your expenses sufficiently efficient, blaming nebulous others for your life and your money is holding yourself down at best and sort of delusional at worst: no one is stopping you. It's free and easy to blame. The incentive to learn money skills is paid in money itself.

Frankly, we don’t even really care how society came to this or how the boomers wrecked everything. It doesn’t matter. We just want to live nice, happy lives and maybe retire at the end in the one world that we’ve got.

And we’re going to do this without social security, and we’re going to do this with our massive student debts paid off and with our own cold hard cash.

No begging. No hand outs. This isn’t us vs. them looking for justice.

This is survival. You and me and our money.

Let’s get our financial lives on track.

SQUARE ONE

First off, this has all been said before. Almost none of what I’m about to say is anything original or new from Brennan Letkeman. I’m just a kid like you who read a lot of books and am going to compress it all down into a series of short posts and add a millennial spin onto some of the outdated 80’s / 90’s literature and worldview because it’s true — those books feel dated.

The thing is, money hasn’t really changed that much.

Buy low, sell high.

Earn more than you spend.

Create value and trade money for it.

Save a little and retire at the end (or don’t, we’ll get to that)

The numbers and math is actually really easy and fun, they just try to make it sound obscure and complex as a method for scaring average people away.

YOUR FINANCIAL DIET

Like a food diet, money comes in and goes out in different ways.

Most of us are the money version of eating Taco Bell all day every day.

Shockingly, this isn’t sustainable. It’s quick hits of pleasure in exchange for long term health effects and I hate to be the adult here, but this post is going to involve some broccoli.

But I think you’re game for that. I think if you’re reading this you’re probably someone who would say ‘yeah, I’d totally eat better if only I knew how!’

So let’s learn our food groups:

SPENDING

You already know what spending is, we do it every day.

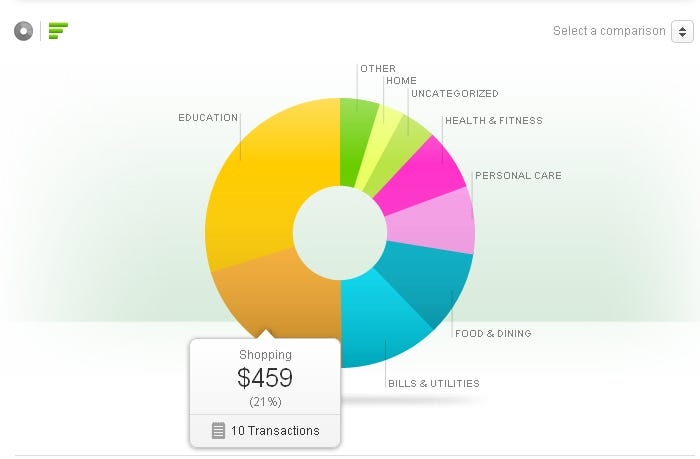

But let’s measure our spending and see where it’s all going. You can only change what you first quantify. Fortunately, there’s apps like Mint that do this for you or programs like YNAB which are more powerful but require some effort and have a small fee (but Mint has minor ads, so)

This is the number one way to get rich:

You don’t need to earn more. You need to spend less.

For two reasons:

1. a 50% reduction in spending is worth a 100% raise.

2. it’s a lot easier to spend less than it is to earn more.

3. bonus reason: when we get to the retirement calculations, you’ll see.

There’s a lot of articles that are all ‘if you just cut Starbucks from your diet that’s $3.50 a day, which is $100 a month!’ and while that’s true, you can save $100 in a lot easier ways. Or like that crap about replacing your lightbulbs with $20 LED ones to save 50 cents on electricity. It’s insignificant busy work.

We’re looking for the big stuff first: rent, car payments / insurance / upkeep, loans and debt, food, entertainment, taxes, health insurance, bank fees, cable bills, Steam games on opening day instead of waiting for the Summer Sale.

All of your fundamental lifestyle and existence is up for questioning here.This is Mint’s interface, by the way

When we look at spending in a chart like this we can see where the big money is going: this example person obviously has a lot of student loans or schooling fees in the present tense and apparently doesn’t pay rent.

Personal care, health, uncategorized and ‘other’ make up a quarter of spending and we might not even realize what they are or why we’re buying them.

So this process is a personal audit and we’re just taking stock before we take any actions. Knowing is half (actually like 90%) of the battle. The changes themselves are relatively easy once you know what they are.

All this is the gate and counting meter for cashflow outwards.

EARNING

This is the fun part, right?

We’re going to get into how to make more and look at alternate money making methods later, but for now this is just income as cashflow inwards.

Could be your student loans as they’re paid to you, could be your McDonald’s burger flipping job, could be your career 9–5 job, whatever. It’s cash in.

This section is actually pretty short in this introductory post because I’m almost tempted to say it doesn’t even matter. Just work whatever it is you can work and earn as much as possible while you’re there. Standard fare advice.

This tends to be easier to quantify because you know what your paycheque is and that’s generally clean income money since it already has taxes and your company healthcare plan and that sort of thing removed. Whatever’s on the cheque truly is yours to spend.

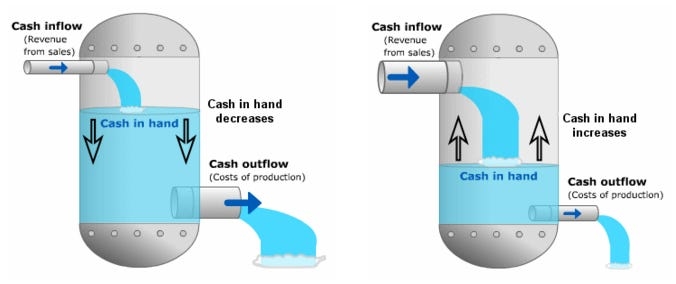

I borrowed these from a company slide, but same principles apply

THE DIET

With these two ingredients we can determine flow.

If your earning is higher than spending, the tank fills up and you’re saving.

If your spending is higher than earning, the tank empties and you’re broke.

And this is a dynamic system, sometimes your spending will be high (like an emergency: you wreck your car and suddenly you’re down $4k in a weekend) and sometimes your earning will be high (you sell something on Craigslist, maybe you do a side project and earn money).

The tank in this case is your bank account, but also in a way your physical ownership of things that could be sold in the future. This is called equity.

Retirement, then, is just filling up the tank.

And, the cool part is, we have a secret weapon: age.

HOW TO EXPLOIT YOUR SECRET WEAPON CALLED AGE

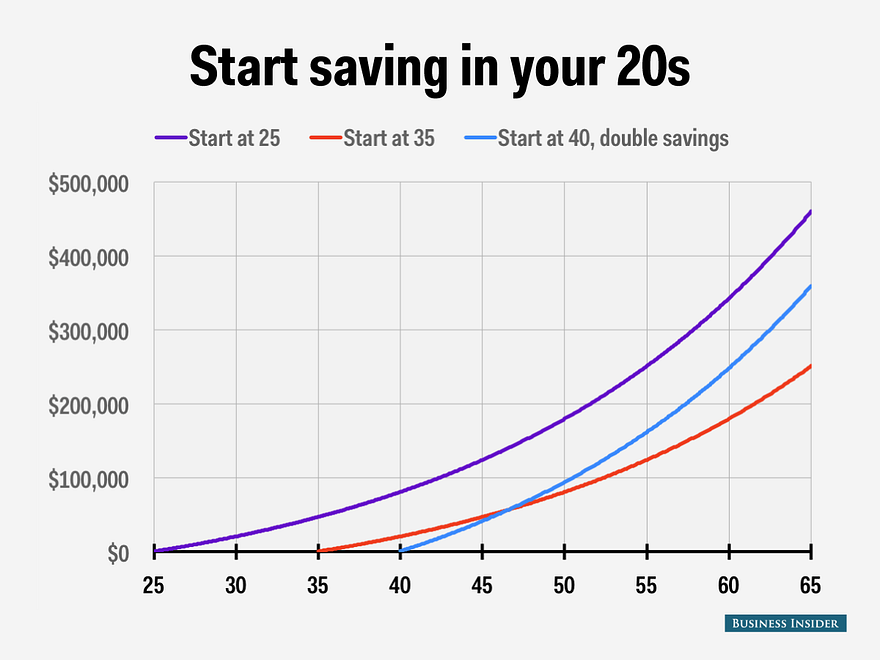

This is the thing middle aged people hate about retirement. It’s super hard for them and it’s really easy for us. Let’s check out some math:I was going to make my own graph but look! There already is one

Purple is 25 and saves $300 a month

Red is 35 and saves $300 a month

Blue is 40 and has to put $600 per month in just to get less cash in the end.

As a young person, compound interest is on our side. Compound interest is free money over time and what do we have? A lot more time.

Here’s some other fun facts:

If you’re saving $5000 a year over those 40 years, waiting even one extra year means the difference of $40k in the end.

This isn’t strictly true with all saving because of how curves work and all the variables involved, but with just that example we could say a dollar saved now is worth 8 dollars in the end.

Suddenly that $3.50 latte is worth $28.

Is it worth $28?

Suddenly that $300 a month extra in rent for a trendier place is worth $29k a year more. You can do a heck of a lot with thirty large, and I can assure you those stainless-front fridges don’t work that much better.

So this is the main thought I want to leave you with here at the end of the introduction post: become incredibly intimate with every dollar you spend. I won’t tell you that you should or shouldn’t spend it, but just get to know where it’s going and evaluate for yourself what your actual values are.

You might find that you don’t need half the stuff you think you do.

Last updated